EU Wants Companies to Adopt a Common Charging Port

EU Wants Companies to Adopt a Common Charging Port

EU Wants Companies to Adopt a Common Charging Port: The European Union’s offered to take on a typical charging port for cell phones. Tablets and earphones moved forward on Wednesday when an. EU board supported the proposition, preparing for a get together vote one month from now.

The European Commission proposed a solitary versatile charging port over 10 years prior. Trusting telephone producers would have the option to track down a typical arrangement. It proposed draft regulation last year, a world first, after they neglected to do as such.

The European Parliament’s Internal Market and. Consumer Protection Committee on Wednesday concurred with the Commission’s proposition.

Apple Says It’s Using More Recycled Materials Than Ever Before

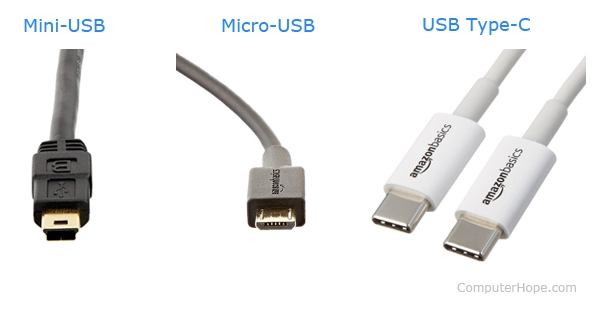

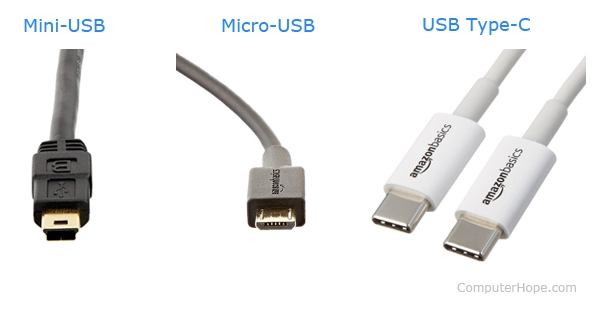

Apple’s iPhones are charged from a Lightning link while. Android-based gadgets are controlled utilizing USB-C connectors. Most of telephones sold in the EU are Android gadgets.

“With around 50% of a billion chargers for versatile gadgets delivered in. Europe every year, producing 11,000 to 13,000 tons of e-squander, a solitary. Charger for cell phones and other little and medium electronic gadgets would help everybody,” said. Alex Agius Saliba, who is driving the discussion in parliament.

The board needs the USB Type-C port to be the norm for. Cell phones, tablets, earphones, tablets, low-fueled workstations, consoles, PC mice, earbuds, brilliant watches and electronic toys.

Apple MagSafe Battery Pack Can Now Charge iPhones Faster

Apple has said the proposition would hurt advancement and make a heap of waste in the event that buyers had to change to new chargers.

The United States Treasury presently has its line of sight on. Russian crypto excavators interestingly as Russia’s attack of Ukraine enters its third month. The US Treasury Department’s Office of Foreign Asset Control (OFAC) delivered an official statement on April 20 declaring new. Authorizes against Russia-based cryptographic money digger BitRiver as well as 10 auxiliaries to its Specially. Designated Nationals list. The move is characteristic of a more extensive push against. Russia’s crypto mining industry albeit the depository specifies no specific relationship among BitRiver and Vladimir Putin’s system.

The Treasury office expressed that dependence on fiat installments and the importation of. PC gear makes Russia helpless against sanctions assuming the. US centers around blocking the organizations offering those types of assistance.

Since government substances can’t stop the real course of mining. Bitcoin, the US Treasury chose to use other assault vectors that debilitate the store network.

Coinbase’s NFT Marketplace Enters Beta Phase

“Depository is likewise making a move against organizations in. Russia’s virtual money mining industry,” said an administration explanation. “By working immense server cultivates that sell virtual cash mining limit universally, these organizations assist. Russia with adapting its regular assets,” the assertion adds.

Russia enjoys a near benefit in crypto mining because of energy assets and. A cool environment. In any case, mining organizations depend on imported. PC hardware and fiat installments, which makes them powerless against sanctions.”

The BTC mining organization referenced in the public statement. BitRiver, was established in 2017 and has three workplaces dissipated across Russia. Lawful possession was changed to a Switzerland-based holding organization in 2021, in any case, this. Organization has been assigned as working in the. “Russian Federation economy,” consequently making it and its ten. Russian-based auxiliaries sanctionable.

Binance Sorry Over Swastika-Featuring Emoji Launch on Hitler’s Birthday

The move additionally shows up a day after the International. Monetary Fund (IMF) gave a report cautioning that Russia could attempt to utilize crypto to avoid sanctions.

Uncertainty governed the crypto market mid-week as Bitcoin flipped among gains and misfortunes on the day to ultimately stay in the green as hopefulness around more BTC trade exchanged reserves (ETF) being endorsed helped its objective. As far as worth, Bitcoin keeps on holding firm ground at around the $41,600 (generally Rs. 32 lakh) mark across trades like CoinMarketCap, Coinbase and Binance. At the hour of composing, the worth of Bitcoin is up 1.06 percent in the beyond 24 hours and stands at $43,605 (generally Rs. 33.5 lakh) on Indian trade CoinSwitch Kuber.

On worldwide trades, the cost of Bitcoin remains at $41,670 (generally Rs. 31.5 lakh) rising 0.73 percent in esteem throughout the course of recent hours. According to CoinGecko information, BTC has move by 1% in esteem week-to-day.

Ether, also had somewhat of a rollercoaster day of exchange through Wednesday albeit the second most famous digital money additionally oversaw gains on the day. At the hour of distributing, Ether is esteemed at $3,243 (generally Rs. 2.5 lakh) on CoinSwitch Kuber while values on worldwide trades see the crypto’s worth at $3,096 (generally Rs. 2.3 lakh), where the coin has ascended by 0.24 percent throughout recent hours.

Robinhood Inks Deal to Buy UK Crypto, Fintech Firm Ziglu

CoinGecko information uncovers that the digital currency’s worth has somewhat deteriorated over the course of the last week with a 1 percent plunge.

According to Gadgets 360’s cryptographic money cost tracker, most altcoins stamped minor misfortunes on the day in spite of BTC and Ether overseeing gains. The worldwide crypto market cap saw an ascent of 0.51 percent throughout the course of recent hours. Torrential slide, Litecoin, Solana, and Polygon all enlisted plunges on the day while Binance Coin, Cardano, Polkadot, Uniswap, and Chainlink checked gains.

Shiba Inu and Dogecoin, in the mean time, had a forgettable day with misfortunes setting up as of now. somewhere near 0.55 percent over the course of the last day.

WazirX Not Moving Base to Dubai, Head Office Remains in Mumbai

The negative opinion to start Wednesday showed up as the International Monetary Fund (IMF) empowering worldwide policymakers to foster guidelines for crypto in light of developing worries featured by the conflict in Ukraine.

In its Global Financial Stability Report distributed on April 19, the IMF straightforwardly tended to crypto’s possible use in sanctions avoidance by Russia and its capability to undermine the solidness of existing monetary frameworks through the changing financial scene.

In other crypto news, the monster crypto trade Binance uncovered its new Twitter emoticon Wednesday, and before long brought it down after clients directed out its similarity toward a ‘insignia’.