HDHP and PPO: What’s the difference?

HDHP and PPO: What’s the difference? Choosing the best health care plan for you can be a difficult process. After reviewing your health benefits when starting a new job or during the open enrollment, you may have more questions than answers.

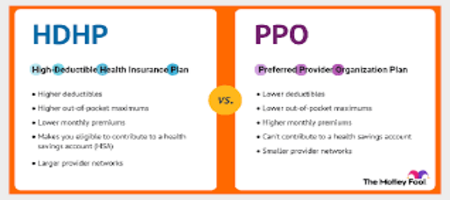

High deductible health plans (HDHP) and preferred provider organization (PPO) plans are two common options employers offer for health insurance. One of these plans may not always be better than the other. When it comes to choosing between an HDHP and PPO plan, the answer to the best plan varies from person to person. Even for a person, it can change from year to year depending on their circumstances.

A high-exemption plan is a type of health insurance with a higher exemption but a lower premium. You’ll pay less each month, but you’ll have more out-of-pocket costs for medical expenses before insurance coverage begins.

It is a type of plan that has lower PPO exemptions but higher monthly premiums. You will pay more each month, but have lower out-of-pocket costs for medical services and have access to a wider range of services or providers.

HDHPs often benefit healthier consumers who don’t expect to need much medical attention throughout the year, and their benefits include lower monthly premiums, said Susan Beaton, former VP of Provider Services, Care Management and Risk at Blue Cross and Blue Shield of Nebraska. . .

Beaton says a low deductible PPO in particular may be appropriate for those awaiting frequent doctor visits and prescriptions because of a condition such as a chronic condition.

Pros and cons of HSA vs HDHP

An HDHP is useful for those who do not expect to have a lot of medical expenses during the year. Typically, HDHPs are beneficial for younger people, those without a family, and those who are generally healthy. Note that with an HDHP plan, you may not be able to pay additionally for doctor visits. until it meets the high exemption rate.

Beaton, be sure to ask if your employer offers an HDHP with a Health Savings Account (HSA). When you choose an HDHP, you can also choose to use an HSA with employer contribution. HSAs are sometimes not offered for employer-sponsored PPO plans, but you can alternatively use a flexible expense account ( FSA ) with PPO plan types.

An HSA is a pre-tax savings account used as a payment method for approved medical expenses. The money in this savings account changes from year to year; however, this is the maximum contribution per year, which differs between individual plans ($3,550) and family plans ($7,100).

An HSA is particularly advantageous

An HSA is particularly advantageous because it uses pre-tax dollars and provides tax-free earnings. HSAs cover a wide range of eligible expenses, including medical services, vision, dental care, and prescriptions. Your HSA funds stay with you even if you change plans or change jobs. They can also be shared with your family.

HDHPs are increasingly popular to use with HSAs, especially for younger people. While an HSA may seem like an attractive benefit, these savings accounts may include monthly maintenance fees and using your HSA debit card at the pharmacy or doctor’s office.

HSAs also require you to stay on top of your records and present your receipts for approval of qualified medical expenses. Some claims may not be paid by the HSA administrator if they are not eligible for expenses. Check with your HSA administrator before making any questionable purchases at a pharmacy or elsewhere.

Also, if you use your HSA for unqualified expenses before age 65, you will face tax and a 20% penalty. Affordable Care Act (ACA). Some people think of an HSA as an emergency fund, but with these considerations, you might think more carefully about how you view an HSA.

Pros and cons of PPO

PPOs are generally better for those who expect to spend more on medical throughout the year. These plans are typically beneficial for the elderly, those with families, and people with health conditions that require regular treatment.

As you get older, face health problems, or support a family, a PPO may start to make more sense. PPOs have higher monthly insurance premiums, but they can help you save money in the long run if you need healthcare frequently. By investing more in your health insurance throughout the year, you can cover more of your health expenses.

PPOs also come with added flexibility benefits. In a PPO plan, you have the freedom to choose the doctor or hospital you want. Even if they are not in your network, your insurance will often continue to offer coverage. With a PPO, you can see a specialist or have a procedure or test done without the approval of your primary care physician. If flexibility in your healthcare choices is important to you, a PPO plan may be better than an HDHP.

Which plan is worth it?

We will now review how you decide whether an HDHP or a PPO plan is better for you. First, consider the following questions:

- How often do you go to the doctor?

- Do you have a chronic health problem that requires frequent treatment?

- How often do you need emergency care?

- Do you have any upcoming surgery planned?

- Are you expecting a baby this year?

- Do you also support the medical expenses of a spouse or a child?

- How important is flexibility when choosing a preferred doctor?

- How important is flexibility to see a specialist?

If you visit the doctor frequently, have a chronic condition, frequently seek emergency care, plan surgery, have a baby, support the medical expenses of multiple family members, or care about flexibility, a PPO will be better than an HDHP. However, if none or more of these aspects are important to you, you’ll likely be better suited to an HDHP.

Note: HDHP and PPO plans are not your only health insurance options. There are also Health Care Organizations (HMO), Private Provider Organizations (EPO), and Point of Service plans (POS).

RELATED: HMO vs PPO

Next, make sure you understand the key terms associated with each of these. health insurance plans .

- Reward: How much do you pay each month to have health insurance?

- Deductible: How much upfront do you have to pay annually for medical care. Once you meet your exemption, health insurance coverage kicks in.

- Out-of-pocket limit: After you spend this amount on out-of-pocket medical care within one year (excluding premiums), your insurance will pay 100% of the eligible expenses.

- HSA: A pre-tax health savings account that can be used with an HDHP. Contributions to HSA plans are renewed annually.

- Copay: A flat fee you pay for prescriptions, checkups, and other healthcare services.

- Coinsurance: The percentage of expenses you pay for medical expenses covered after you cover your exemption.

HDHP and PPO calculator

Understanding the terms above can help you navigate the calculations of how much you will pay for health insurance. When deciding between the two, you should first estimate your annual medical expenses. A healthy individua犀利士

l may not have many estimated expenses. However, they need to consider the possibility of catching the flu or being injured.

After estimating your medical expenses, add in each plan’s monthly premium and corresponding out-of-pocket limits. Assuming you’re using the in-network transaction, this number will be your absolute out-of-pocket maximum cost for the year.

As an example, a PPO plan can have a monthly premium of $600 with a $1,250 deductible. After multiplying the monthly premium by 12 months ($600 x 12) and adding the deductible for out-of-pocket costs, this comes to an annual total of $8,450 excluding copays or coin insurance. That said, out-of-pocket maximum group plans are $8,150 for individuals and $16,300 for families in 2020. Your out-of-pocket expenses may be less than or equal to this limit.