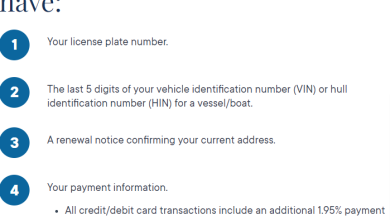

There are many different health insurance policies to choose from if you want to purchase one. The coverage they provide and the premium amounts that must be paid can be perplexing at times. Health insurance premiums differ from one insurer to the next and from one consumer to the next. Your age, gender, income, and family history of illnesses influence your health insurance premium.

Health insurance is becoming increasingly important in India, particularly in metropolitan areas. This is due in part to increased medical care costs as well as the current COVID-19 outbreak. While it can provide financial security, the amount of premium you must pay for this coverage is a significant factor to consider.

The expense of healthcare facilities is rising every day all around the world. Purchasing a health insurance coverage is one of the most cost-effective ways to deal with rising medical costs and provide the finest possible medical care. This expense may also appear to be excessive at times.

It is necessary to understand what is causing your health insurance policy to be so costly. In this blog, we’ll look at some of the key factors that go into determining the amount of health insurance premium a policyholder pays. Let’s get this started!

The Insured’s Age

Your age is a crucial factor in deciding health insurance premiums. This is because as one gets older, the chances of death, hospitalization, and medical expenses increase.

Thus, a 50-year-old individual requires to pay a premium of Rs. 6,208 per year (for an amount insured of 3 lakh), whereas a 25-year-old person would be had to pay a substantially lesser premium of Rs. 2,414 per year.

Furthermore, some insurance firms impose an age limit of 65-80 years for individuals purchasing a new health insurance policy, as determining risk factors and health-related charges becomes more difficult as one gets older.

The Plan That Has Been Chosen

The cost of your health insurance will vary based on the type of plan you select. A family floater plan, for example, is usually less expensive than an individual coverage because the chances of one person becoming ill are higher. However, keep in mind that the oldest covered member’s age determines the premium for a family floater plan.

Sum Insured

The amount of coverage you choose influences your health insurance rate. Because the sum insured is the maximum amount you can claim from your insurer for medical expenses, a smaller SI can result in a lower premium, while a higher SI can result in a higher premium.

However, if your overall medical expenditures exceed your SI amount, you will be responsible for the difference. As a result, you must choose your SI carefully because you do not want to raise your emergency fund.

Habits and Lifestyle

Smoking, chewing tobacco, and snuffing are all bad behavior that will raise your premium. These habits raise the risk of lung infections, cancer, and other serious illnesses, resulting in a higher health insurance premium for smokers than for non-smokers.

For smokers, this rise can be nearly double that of non-smokers. For example, if a 25-year- old nonsmoker is required to pay Rs. 5,577 every year for a total of one crore, a smoker of the same age would be required to pay roughly Rs. 9,270 per year.

Pre-existing Diseases

When a person has pre-existing medical disorders that have had a long-term impact on their health, such as diabetes, high blood pressure, or asthma, they are more likely to incur additional hospital costs as well as medical expenditures. This implies they’ll have to pay a greater premium than healthy persons in their age bracket. The amount of your premium increase is determined by the severity of your pre-existing ailment as determined by a doctor.

Co-Payment

A co-payment is a percentage of the claim amount that you must pay under health insurance. If you have a 15% copay, for example, your insurer will pay out 85 percent of the claim amount and you will be responsible for the balance. As a result, your medical expenditures are shared between you and your insurer.

Some health insurance policies require a copayment, while others allow you to determine the amount of your copayment. It’s worth noting that while a greater co-pay lowers your overall premium, it also means you’ll have to pay a bigger amount during claims. However, if you have a reduced co-pay, your premium will be slightly more, but you will pay less during claims.

Add-On Covers

Additional coverages (add-ons or riders) are optional coverages that you can add to your existing health insurance policy to improve its benefits. You will have to pay an additional premium if you choose to personalize your health insurance with add-on covers such as Maternity Cover, Critical Illness Cover, Personal Accident Cover, or AYUSH Treatment. The total premium for all add-ons purchased under a single health insurance policy, according to the IRDAI, cannot exceed 30% of the original premium amount. So, if your annual premium is Rs. 5,000 and you opt to purchase f犀利士

ive add-ons, the additional premium cannot exceed Rs. 1,500.

Medical History of the Family

If any of your immediate family members (such as your parents or grandparents) have a history of illnesses such as heart disease, cancer, Alzheimer’s disease, or other similar conditions, you have a higher chance of getting them yourself. Your premium will go up as a result of this.

Where You Live (Zones)

In terms of dangers, medical expenditures, and other environmental elements such as pollution, climate, and so on, each geographic area will be unique. In India, you categorize cities into zones based on the cost of medical care in that location. The higher the city’s medical costs, the higher its zone, and the higher your premium.

Obesity

Overweight people (whose BMI is over 25) may develop diabetes or hypertension, according to insurance companies. And, because they may file health insurance claims in the future, they may pay a higher premium.

Nature of Your Work

The level of risk you face at work that includes your premium. Those who work in safer environments, requires to pay less than those who work on a construction site or in a factory, where the danger of injury is higher.

The main elements that can influence the amount of health insurance premium, makes you understand what to expect while purchasing policy. After evaluating these factors, you can use an online health insurance premium calculator to figure out your premium.

How To Use Health Insurance Premium Calculator to Find Out My Premium?

With the help of a health insurance premium calculator, it is now simple to determine the amount of your premium. The health insurance premium calculator is accessible over the internet. You can use it any time and from any location.

Simply go to the website of your insurer and look for the health insurance rate calculator. You can fill in some basic information to get an estimate of how much premium you’ll have to pay. You can also change the amount by changing key variables while using the mediclaim premium calculator.