What Is An Installment Loan?

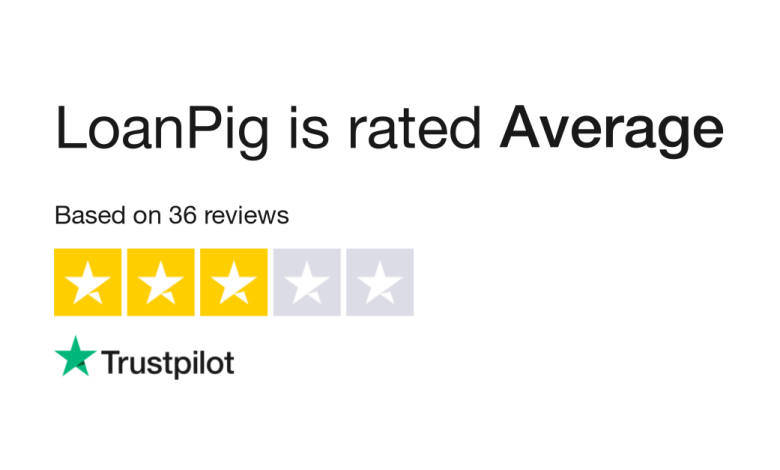

An installment loan lets you borrow a predetermined amount of money over some time. The loan will then be paid in installments. You can also find installment loans with fixed payment amounts. That means the amount will not change over the loan’s term. If you have a variable interest, it may change LoanPig offers payday loans.

Although you may not be familiar with the term “installment Loan”, it is probably something you have heard of or used.

It is a type of loan that allows you a predetermined amount of money to borrow when you take out the loan. You have to choose how much money, and no credit.

After borrowing the funds, your installment loan has to be repaid over a predetermined period. You and the lender decide when you take out a loan. Typically, payments are made monthly. However, the schedules can change. The term of the loan describes the amount of time a borrower must repay a loan.

Common Examples Of Installment Loans

Many of the most popular types of loans people take out today are installment loans. These loans can include student loans or auto loans.

Loans

The term of auto loans is typically paid in monthly installments for a period between 12 and 36 months. Not all lenders, however, offer terms that are within this range. You will pay lower monthly installments and receive higher interest rates if you have a longer term. The result is that you’ll pay more overall for a car purchased with an 84 monthly loan. Even though your monthly payment is lower than with a 36-month loan, it will still cost you more.

Personal Loans

Personal installment loans can be used to consolidate debts or pay for unexpected expenses such as medical bills. Personal loans generally have terms between 12 to 96 monthly. They typically have lower interest rates compared to other types of loans. This is because personal loans typically don’t require collateral. Like your car, or house.

Benefits And Conditions Of Installment Loans

LoanPig offers payday loans with predictable payments. A fixed-interest loan will provide predictable payments.

An established payment schedule and amount could help you plan better for your loan payments each month. It will also make it easy to avoid missing payments due to unplanned changes to the amount.

Check that the monthly payment won’t be too high when you shop for an installment mortgage. If they do not, you might struggle to make your full payment in the case of an emergency.

Installment loans allow you to feel secure knowing that your debt will be paid on a given date. When you are done paying the amount due, your debt should have been paid off completely. A shorter repayment term is better for you. You will be able to pay less interest and get out of debt faster.