Business loans are taken by ventures and enterprises in order to meet emergencies and business requirements. At every juncture of growth and expansion, a particular venture needs a smooth flow of capital. Business loans are easily available to business owners with stable credit health and financial background. However, the terms and conditions of the business loan depend upon various factors. If you are able to meet the eligibility criteria, research well, and negotiate, and then apply for a business loan to get the best borrowing experience with favorable terms and conditions.

The type of financial institution that you are borrowing from

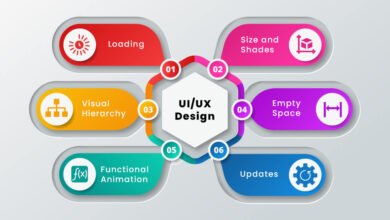

Business loan terms and conditions vary with the loan provider. Since business loans are very popular nowadays, it is easy to find one from a bank or non-banking financial institution. However, it is not at all recommended to opt for the first business loan approval that you get without doing market research. Research is very important when taking a business loan because of the loan terms that you get. Without conducting extensive research, if you end up borrowing, you are completely going wrong. Every loan provider has its own operations, processes, and flexibility.

It is important to compare all the terms and conditions and interest rates of every loan provider with a business loan calculator before finalising. The terms and conditions of your business loan will differ from those of banks and non-banking financial institutions. It is important to understand that banks are very rigid and traditional when it comes to borrowing and lending. However, on the other hand, the non-banking financial institutions are very flexible and smooth. Starting from online borrowing, better rates of interest, unsecured loans, and easy documentation, you get all the flexibility with non-banking financial organizations. However, when you borrow from a bank, you may not get enough flexibility and affordability in business loans.

Eligibility criteria for the business owner

The terms and conditions of a business loan are primarily dependent upon two factors: the eligibility criteria of the business owner and the loan provider. Therefore, it is not only the responsibility of the financial institution but also of the individual. Business owners with good credit health and financial stability always get the best terms and conditions for business loans. However, on the other hand, when you do not have a good credit score or revenue, it becomes difficult to negotiate terms and conditions. In order to enjoy the benefits and privileges of having a business loan, you need to prove your creditworthiness.

Financial institutions are completely okay with the fact that individuals negotiate for better terms and conditions. However, what makes them eligible to negotiate is their credit score and good credit health. Therefore, if you are thinking about appropriate business loan terms and conditions, you need to be eligible for them. When the risk of borrowing is low, financial institutions offer flexible terms and conditions. However, when the risk is high, loan providers try to recover the maximum amount with a high rate of interest and impose strict terms and conditions to avoid default.

Market research is very important

If you are not aware of the competitors in terms of loan providers, you will not know what is right for you. Conducting extensive market research will help you understand the trending loan terms and conditions. When you have completely done your research, it is easier for you to negotiate and speak about the best terms and conditions with your financial institutions. If you do not conduct research, you will bluntly believe what your financial institution tries to convince you of. Therefore, in order to get the best business loan terms and conditions, market research is an important factor.

The type of business loan decides the terms and conditions

Blatantly, there are two forms of business loans. One is a secured business loan and the other is an unsecured business loan. A secured business loan is one that includes security or collateral. On the other hand, unsecured business loans are those that do not have any collateral or security pledged by the financial institution. Depending upon the type of loan, the terms and conditions of a business loan will vary. For example, the rate of interest on a secured business loan is much lower in comparison to an unsecured loan. There is also much more flexibility in terms and conditions in a secured business loan because the risk involved is minimal. Therefore, depending upon the type of business loan you are taking, your terms and conditions will differ.

Must Read: Where and how can you check your credit score?

Negotiation is always important

Negotiate hard with your financial institution if you want better terms and conditions on your business loan. The more you negotiate, the better rate of interest, monthly installment, loan sanction amount, and loan tenure you will get. However, in order to negotiate, it is important to meet the credit eligibility criteria. Once you are able to negotiate, it always helps you to get the best business loan that does not become a burden.

Finishing up

Apply for a business loan in order to meet business expenses and requirements. A business loan calculator always helps you to compare the best deal available in the market.